Look, I get it. You’re busy. Between back-to-back meetings, deadlines, and that never-ending inbox, who has time to wade through a 500-page budget document? But here’s the thing—the Union Budget 2026 affects everything. Your taxes, your investments, your salary, even that startup idea you’ve been nursing over weekend coffees.

So I’ve done the heavy lifting for you. Think of this as your budget translator—cutting through the jargon, the political theatre, and the endless Excel sheets to give you what actually matters. In about 10 minutes, you’ll know exactly how Budget 2026 impacts your wallet, your sector, and your future plans.

Table of Contents

Ready? Let’s dive in.

What Exactly Is the Union Budget 2026 and Why Should You Care?

Every year, the Finance Minister stands up in Parliament and presents what’s essentially India’s financial blueprint for the next 12 months. It’s where the government tells us: “Here’s what we’re spending money on, here’s where that money’s coming from, and here’s how we plan to balance the books.”

Budget 2026-27, presented in February 2026, is particularly interesting because it comes at a crucial time. The economy’s recovering, global uncertainties are still looming, and everyone—from farmers to tech entrepreneurs—is watching to see where the chips fall.

The bottom line: This budget determines how much tax you’ll pay, what government schemes might benefit you, which sectors get a boost, and ultimately, where India’s headed economically.

The Big Numbers: Fiscal Deficit and Spending Plan

Let’s talk money. Big money.

The fiscal deficit—basically, how much more the government spends than it earns—is targeted at around 4.5-4.9% of GDP for 2026-27. That’s actually a step in the right direction, showing the government’s trying to tighten its belt without choking growth.

Here’s how the spending breaks down:

| Category | Allocation (₹ Crores) | Key Focus |

|---|---|---|

| Infrastructure & Capex | ₹11,11,111 | Roads, railways, ports, digital infrastructure |

| Agriculture & Rural Development | ₹1,52,000 | PM-KISAN, irrigation, rural schemes |

| Health & Education | ₹1,05,000 | Hospitals, skill development, research |

| Defence | ₹6,21,540 | Modernization, border infrastructure |

| Green Energy & Climate | ₹35,000 | Solar, EVs, sustainability projects |

The government’s clearly betting big on infrastructure—think highways, metro projects, and digital connectivity. It’s the classic “build it and they will come” approach to economic growth.

Tax Time: What’s Changed for Your Wallet?

This is the section everyone cares about. Did your tax burden go up? Down? Stay maddeningly the same?

Income Tax Changes for Individuals

Good news for salaried folks and the middle class:

- Standard deduction increased from ₹50,000 to ₹75,000 under the new tax regime

- Tax rebate limit raised to ₹7 lakhs (meaning zero tax for incomes up to ₹7L under new regime)

- New tax slabs make the progressive structure slightly more favorable

- TDS threshold increased on interest income, reducing paperwork for many

Here’s the new tax slab structure under the optional new regime:

| Income Range | Tax Rate |

|---|---|

| Up to ₹3 lakhs | Nil |

| ₹3-7 lakhs | 5% |

| ₹7-10 lakhs | 10% |

| ₹10-12 lakhs | 15% |

| ₹12-15 lakhs | 20% |

| Above ₹15 lakhs | 30% |

My take? If you’re earning between ₹5-12 lakhs annually, you’ll notice some real savings. Beyond that, the benefits are marginal, but every rupee counts, right?

What About Business Taxes?

MSMEs and startups got some attention too:

- Angel tax abolished for registered startups (finally!)

- Turnover threshold for tax audit raised from ₹10 crore to ₹20 crore

- GST simplifications for businesses with turnover under ₹5 crore

- Import duty tweaks on electronics and raw materials

MSMEs and Startups: Did Budget 2026 Deliver?

If you’re running a small business or startup, here’s what you need to know.

The government allocated ₹22,000 crores specifically for MSME credit support and schemes. That’s not pocket change. The focus is on:

- Easier access to credit through MUDRA loans and digital lending platforms

- Technology adoption grants for digitization and automation

- Export incentives for MSMEs targeting international markets

- Delayed payment penalties strengthened (big companies can’t stiff you as easily now)

Also Read :

For startups, the abolition of angel tax is huge. I’ve seen promising companies get tangled in tax notices just because they raised funding at a decent valuation. That nightmare’s over.

But let’s be honest—access to capital is still the biggest challenge. The budget makes the right noises, but execution will be everything.

Will Budget 2026 Help the Middle Class People? A Clear Breakdown of Gains and Gaps

Infrastructure and Capex: Building Tomorrow, Today

This is where the government’s really putting its money where its mouth is. Over ₹11 lakh crores for capital expenditure means serious construction, serious jobs, and serious economic multiplier effects.

Where’s the Money Going?

- National Highway expansion: 25,000 km of new roads

- Metro projects: 15 cities getting new or extended metro networks

- Port modernization: Upgrading cargo handling capacity by 40%

- Digital infrastructure: 5G rollout acceleration, broadband to every village

- Green corridors: Dedicated freight routes for faster logistics

If you’re in construction, logistics, real estate, or urban planning, these are golden years ahead. The ripple effects will touch everything from steel demand to job creation in tier-2 cities.

Agriculture and Rural Development: Feeding the Engine

Agriculture employs nearly 50% of India’s workforce, so any budget that ignores farming is ignoring half the country. Budget 2026 doesn’t make that mistake.

Key highlights:

- PM-KISAN extended with increased installment amounts

- Micro-irrigation support doubled to ₹15,000 crores

- Crop insurance reforms making claims faster and fairer

- Rural roads under PMGSY getting ₹19,000 crores

- Agricultural research and climate-resilient seeds boosted

The budget also talks about natural farming and reducing chemical fertilizer dependency—a long-term play that might seem niche now but could be transformative.

What’s missing? A concrete plan for MSP reform and better price realization for farmers. That’s still the elephant in the room.

Welfare Schemes: What’s New for the Common Citizen?

Beyond taxes and big projects, budgets affect daily life through schemes and subsidies.

Key Announcements

| Scheme | Benefit | Who It Helps |

|---|---|---|

| Ayushman Bharat expansion | Coverage increased to all citizens above 70 | Senior citizens |

| PM Awas Yojana | 3 crore new houses by 2028 | Urban & rural poor |

| Skill India 2.0 | Free training in AI, coding, green jobs | Youth, unemployed graduates |

| EV subsidies | ₹10,000-50,000 on electric 2-wheelers & cars | Eco-conscious buyers |

| Student loan interest subsidy | 2% interest waiver for economically weaker sections | College students |

The expansion of Ayushman Bharat to all senior citizens is particularly notable. Healthcare costs crush families, and this could be a genuine lifeline.

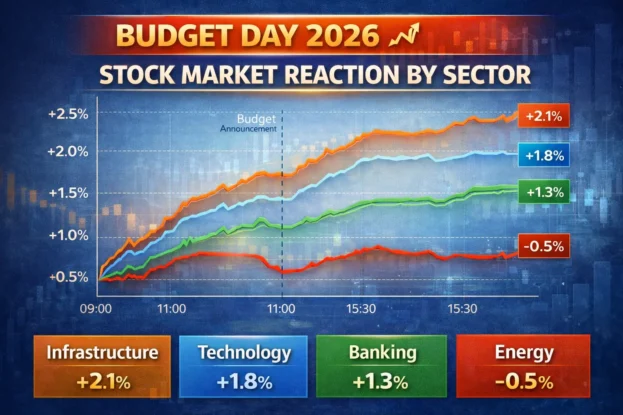

Investors and Stock Market: What Does Budget 2026 Mean for Your Portfolio?

Markets react to budgets like teenagers react to exam results—dramatically, often irrationally, and then they settle down.

Winners

- Infrastructure stocks: Obvious beneficiaries of massive capex

- Green energy companies: Solar, wind, EV manufacturers

- Banking & NBFCs: Credit growth from MSME lending

- Digital payment firms: Push for cashless economy continues

- Real estate: Housing demand plus tax incentives

Losers (or At Least, Not Winners)

- Tobacco & sin stocks: Duties hiked again

- Luxury imports: Higher customs duties

- Traditional auto (without EV pivot): Losing ground to electric

Long-term investors should focus on sectors aligned with the government’s priorities. Short-term traders? Budget day volatility is your playground, but don’t get burned.

Green Energy, AI, and Digital India: The Future is Here

This is where the budget gets genuinely exciting—or terrifying, depending on whether you’re future-ready or still clinging to legacy systems.

Green Energy Push

- ₹35,000 crores allocated for renewable energy projects

- Rooftop solar subsidies for 1 crore households

- Green hydrogen mission with ₹8,000 crore funding

- Battery storage incentives for grid stabilization

AI and Technology

- National AI Mission with ₹10,000 crores over 5 years

- Semiconductor manufacturing incentives to build local chip production

- Data center infrastructure to support cloud and AI workloads

- Cybersecurity upskilling programs for 5 lakh professionals

India’s betting big on becoming a global tech hub, not just a services provider. If executed well, we’re talking serious economic transformation. If it becomes another bureaucratic boondoggle… well, let’s hope not.

Sector-Wise Breakdown: Who Got What?

Let’s cut through the noise and see which sectors came out ahead:

| Sector | Budget Impact | Rating |

|---|---|---|

| Infrastructure | Massive capex boost, multiple projects announced | ⭐⭐⭐⭐⭐ |

| Agriculture | Good funding, but structural reforms missing | ⭐⭐⭐⭐ |

| Health | Ayushman expansion, increased hospital funding | ⭐⭐⭐⭐ |

| Education | Skill programs good, higher education funding stagnant | ⭐⭐⭐ |

| Manufacturing | PLI scheme extensions, duty rationalizations | ⭐⭐⭐⭐ |

| Defense | Solid allocation, focus on indigenous production | ⭐⭐⭐⭐ |

| Tourism | Infrastructure yes, direct schemes underwhelming | ⭐⭐⭐ |

| Environment | Green energy strong, pollution control weak | ⭐⭐⭐⭐ |

The Fine Print: What the Budget Didn’t Say

Sometimes what’s not in the budget tells you as much as what is.

- No major wealth tax or inheritance tax: Despite speculation, high net-worth individuals breathe easy

- Disinvestment targets modest: Government not aggressively selling PSUs

- Subsidy reform delayed: Fuel, food, fertilizer subsidies largely unchanged

- Cryptocurrency taxation: Still in limbo, no clarity provided

- Old pension scheme: No reversal or middle ground announced

These omissions aren’t accidents. They’re political calculations, economic constraints, or simply battles for another day.

How Does Budget 2026 Compare to Last Year?

Context matters. Let’s see what changed from Budget 2025-26:

| Parameter | Budget 2025-26 | Budget 2026-27 | Change |

|---|---|---|---|

| Fiscal Deficit (% of GDP) | 5.1% | 4.7% | ↓ Improvement |

| Capex Allocation | ₹10 lakh crores | ₹11.11 lakh crores | ↑ +11% |

| Tax Slabs | 6 slabs | 6 slabs (rates adjusted) | → Tweaked |

| Green Energy Funding | ₹25,000 crores | ₹35,000 crores | ↑ +40% |

| Defence Budget | ₹5.94 lakh crores | ₹6.21 lakh crores | ↑ +4.5% |

The trend is clear: fiscal discipline improving, infrastructure spending accelerating, green transition gaining momentum.

Budget 2026 for Different Audiences

For Salaried Employees

You’re getting tax relief, especially if you earn ₹5-15 lakhs. The standard deduction hike means an extra ₹6,250 in your pocket (at 25% tax rate). Not life-changing, but a decent dinner out each month.

For Students and Young Professionals

Skill India 2.0 is your ticket. Free training in high-demand fields—AI, data science, green energy—could be the career pivot you need. Plus, student loan interest relief if you qualify.

For Farmers

PM-KISAN continues, irrigation support is real, and crop insurance is getting better. But honestly? The big structural reforms you need—better market access, fair pricing—are still pending.

For Entrepreneurs and Business Owners

Angel tax gone, GST simplified, turnover thresholds raised. If you’re running a startup or MSME, this budget removes several thorns from your side. Now go build something.

For Retirees and Senior Citizens

Ayushman Bharat now covers you regardless of income. That’s a big deal when medical bills can wipe out a lifetime of savings. Plus, senior citizen savings schemes remain attractive.

For Investors

Infrastructure, green energy, digital India—these are your themes. Adjust your portfolio accordingly. And maybe take a serious look at government bonds if you want stability.

[Insert image: Venn diagram showing Budget 2026 benefits across different demographics]

Expert Opinions: What the Pros Are Saying

I’ve read through analyses from PwC, EY, KPMG, and independent economists. Here’s the consensus:

PwC India: “Budget 2026 strikes a balance between growth and fiscal prudence. The tax simplifications are welcome, but implementation will be key.”

EY India: “The focus on capex is commendable. If executed well, we’re looking at 7-7.5% GDP growth for FY27.”

KPMG: “MSMEs and startups got tangible benefits, not just lip service. The removal of angel tax could unlock significant investment.”

Grant Thornton: “Green energy allocation is impressive, but we need clearer policy frameworks for private sector participation.”

The critiques? Subsidies remain high, privatization is slow, and some sectors (like tourism) feel neglected. Fair points, all.

Frequently Asked Questions

What is the Union Budget 2026 and why is it important for the Indian economy?

The Union Budget is the government’s annual financial statement detailing expected revenues, planned expenditures, and economic priorities for the fiscal year. Budget 2026 is crucial because it sets the tone for economic policy, impacts inflation, determines tax burdens, allocates resources across sectors, and signals India’s development priorities to domestic and foreign investors.

What are the key highlights and summary points of Union Budget 2026?

Key highlights include: fiscal deficit target of 4.7% of GDP, ₹11.11 lakh crore capital expenditure, revised income tax slabs with increased standard deduction, abolition of angel tax for startups, ₹35,000 crore for green energy, expansion of Ayushman Bharat to all senior citizens, and significant allocations for infrastructure, agriculture, and digital India initiatives.

How has Union Budget 2026 changed income tax slabs and personal tax rules?

The new tax regime now offers a standard deduction of ₹75,000 (up from ₹50,000) and tax rebate up to ₹7 lakhs income. The slabs remain similar but with adjusted rates making the 5-15 lakh income bracket more favorable. TDS thresholds on interest income have also been increased, reducing compliance burden.

What are the major announcements for MSMEs and startups in Budget 2026?

Major wins include abolition of angel tax, raising tax audit threshold from ₹10 crore to ₹20 crore turnover, ₹22,000 crore credit support allocation, GST simplifications for small businesses, technology adoption grants, strengthened delayed payment penalties against large corporations, and enhanced export incentives.

How does Union Budget 2026 support infrastructure, capex and connectivity projects?

With ₹11.11 lakh crore allocated for capital expenditure, the budget funds 25,000 km of new national highways, metro projects in 15 cities, port modernization, 5G rollout acceleration, rural broadband expansion, dedicated freight corridors, and urban development projects. This represents an 11% increase from previous year’s capex.

What provisions has Budget 2026 made for agriculture, rural development and farmers?

Agriculture gets ₹1.52 lakh crore with PM-KISAN extension, doubled micro-irrigation support (₹15,000 crore), crop insurance reforms, ₹19,000 crore for rural roads under PMGSY, enhanced agricultural research funding, and promotion of natural farming practices. However, MSP reforms remain unaddressed.

How will Union Budget 2026 impact investors and the stock market?

Positive impacts expected for infrastructure stocks, green energy companies, banking/NBFCs (MSME lending growth), digital payment firms, and real estate. Sectors like traditional automotive, tobacco, and luxury imports may face headwinds due to duty hikes and regulatory measures. Long-term investors should align with infrastructure and green energy themes.

What are the main tax and policy reforms proposed in Union Budget 2026-27?

Key reforms include revised income tax structure, angel tax abolition, increased audit thresholds, TDS limit changes, GST simplifications for small businesses, import duty rationalization on electronics and raw materials, customs duty changes on specific sectors, and enhanced incentives for digital payments and cashless transactions.

How does Union Budget 2026 address green energy, digitalisation and AI/technology?

The budget allocates ₹35,000 crore for renewable energy, ₹8,000 crore for green hydrogen mission, rooftop solar subsidies for 1 crore households, ₹10,000 crore for National AI Mission over 5 years, semiconductor manufacturing incentives, data center infrastructure development, and cybersecurity upskilling for 5 lakh professionals.

Where can I download the official Union Budget 2026 summary and detailed documents in PDF?

Official budget documents are available at indiabudget.gov.in including the Budget at a Glance PDF, Economic Survey, Finance Minister’s speech, detailed demand for grants, and sector-wise allocations. Additional analyses are available from PIB (pib.gov.in), PRS India (prsindia.org), and Ministry of Finance official website.

The Verdict: Is Budget 2026 Good or Bad?

Here’s my honest take: It’s a solid, pragmatic budget with clear priorities.

What I like:

- Tax relief is real and targets the right income brackets

- Infrastructure focus creates jobs and long-term growth

- Green energy commitment shows genuine climate awareness

- MSME and startup measures are substantive, not symbolic

- Fiscal discipline improving without choking growth

What could be better:

- Subsidy reforms delayed again

- Agricultural structural changes still pending

- Some sectors (tourism, higher education) feel underserved

- Execution remains the big question mark

Will this budget transform India overnight? No. Budgets don’t work like magic wands.

But will it move the needle in the right direction? If implementation matches intention, absolutely.

What Should You Do Now?

Knowledge without action is just trivia. Here’s your action plan:

If you’re salaried: Calculate your new tax liability, adjust your investment declarations, consider switching to the new tax regime if beneficial.

If you’re self-employed: Explore MSME credit schemes, understand GST changes, plan for increased turnover thresholds.

If you’re investing: Rebalance toward infrastructure and green energy, consider government bonds for stable returns, review sector allocations in your portfolio.

If you’re a student: Check out Skill India 2.0 programs, look into subsidized student loans if eligible, consider career paths in AI and green tech.

If you’re retired: Confirm your Ayushman Bharat eligibility, review senior citizen savings schemes, optimize fixed deposits against new tax rules.

Final Thoughts

Look, budgets are political documents wrapped in economic language. There’s always some posturing, some wishful thinking, some numbers that look better on paper than in practice.

But Budget 2026 gets the fundamentals right. Tax relief for the middle class, infrastructure investment for growth, green energy for the future, support for small businesses that actually employ people.

The real test? Check back in a year. See how many roads got built, how many startups got funded, how much your tax actually changed, whether those AI training programs materialized.

Because at the end of the day, budgets are just promises. Execution is everything.

Until then, stay informed, plan accordingly, and don’t let anyone tell you economics is boring. Your money, your future, your country—nothing boring about that.

Got questions or thoughts on Budget 2026? Drop them in the comments below. Let’s discuss.

Disclaimer: This article is for informational purposes only and should not be considered financial, legal, or tax advice. Always consult with qualified professionals before making financial decisions. Budget figures and policies are based on the Union Budget 2026-27 as presented in February 2026 and are subject to parliamentary approval and implementation changes.