Teachers play one of the most important roles in society, yet their financial planning is often conservative and goal-oriented. Whether you are a government school teacher, private school educator, college professor, or retired teacher, investing smartly through mutual funds and SIP plans can help you build long-term wealth without daily market stress.

This detailed guide explains the best mutual funds and SIP plans to invest for a teacher in India in 2026, covering retirement, child education, tax saving, and low-risk income goals.

Table of Contents

Why Mutual Funds and SIPs Are Ideal for Teachers

Teachers usually prefer investments that are:

- Stable and disciplined

- Low to moderate risk

- Suitable for monthly salary-based investing

- Helpful for long-term goals like retirement and education

This is exactly where SIP mutual funds for teachers work best. A Systematic Investment Plan (SIP) allows you to invest a fixed amount every month — even starting from ₹1,000 or ₹5,000 — without worrying about market timing.

Key advantages for teachers:

- Automatic investing from salary

- Power of compounding over 10–20 years

- Better returns than traditional savings options

- Flexibility to pause or increase SIPs

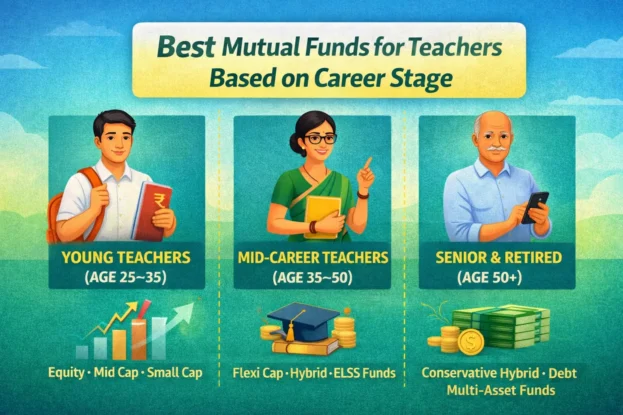

Best SIP Investment Strategy for Teachers (By Career Stage)

Young Teachers (Age 25–35)

- Higher risk capacity

- Long investment horizon (15–25 years)

- Suitable for equity, mid-cap, small-cap funds

Mid-Career Teachers (Age 35–50)

- Balanced growth + safety

- Goals: child education, home, retirement

- Ideal for flexi-cap, hybrid, ELSS funds

Senior & Retired Teachers (Age 50+)

- Capital protection matters more

- Regular income focus

- Prefer conservative hybrid, debt, multi-asset funds

Top 20 Best Mutual Funds and SIP Plans for Teachers (2026)

Below are SIP-eligible Direct-Growth mutual funds suitable for teachers, selected for stability, long-term consistency, and goal-based investing.

Disclaimer: Past returns are not guaranteed. Always consult a SEBI-registered financial advisor before investing.

| Fund Name | Category | Why Suitable for Teachers |

|---|---|---|

| Parag Parikh Flexi Cap Fund | Flexi Cap | Low volatility, long-term education & retirement goals |

| ICICI Prudential Bluechip Fund | Large Cap | Stable returns for conservative teachers |

| HDFC Flexi Cap Fund | Flexi Cap | Flexible allocation, salary-based SIP friendly |

| Nippon India Large Cap Fund | Large Cap | Reliable retirement-oriented fund |

| Quant Flexi Cap Fund | Flexi Cap | Higher growth for moderate-risk teachers |

| Invesco India Mid Cap Fund | Mid Cap | Growth-focused for mid-career teachers |

| Edelweiss Mid Cap Fund | Mid Cap | Strong long-term SIP performer |

| Bandhan Small Cap Fund | Small Cap | High-growth option for young teachers |

| ICICI Prudential Multi Asset Fund | Multi Asset | Equity + debt + gold diversification |

| SBI Multi Asset Allocation Fund | Multi Asset | Stability during market volatility |

| DSP ELSS Tax Saver Fund | ELSS | Tax saving under Section 80C |

| Mirae Asset ELSS Tax Saver Fund | ELSS | Tax benefit + long-term growth |

| SBI ELSS Tax Saver Fund | ELSS | Popular tax-saving SIP |

| ICICI Pru Equity & Debt Fund | Aggressive Hybrid | Balanced growth with lower volatility |

| Quant Aggressive Hybrid Fund | Hybrid | Dynamic asset allocation |

| Kotak Debt Hybrid Fund | Conservative Hybrid | Ideal for retired teachers |

| ICICI Pru Regular Savings Fund | Conservative Hybrid | Low-risk monthly income |

| UTI Nifty Index Fund | Index | Low-cost passive investing |

| HDFC Large & Mid Cap Fund | Large & Mid Cap | Growth + stability combination |

| ICICI Pru Value Discovery Fund | Value | Long-term wealth creation |

Also Read: How to Check Income Tax Refund Delay Status

Best Mutual Funds for Teachers Based on Financial Goals

Best Mutual Funds for Teacher Retirement Planning

- ICICI Prudential Bluechip Fund

- Nippon India Large Cap Fund

- Parag Parikh Flexi Cap Fund

- SBI Multi Asset Allocation Fund

Best SIP Plans for Teachers’ Child Education

- HDFC Flexi Cap Fund

- Invesco India Mid Cap Fund

- Edelweiss Mid Cap Fund

- Bandhan Small Cap Fund (long horizon)

Best Tax-Saving ELSS Funds for Teachers

- DSP ELSS Tax Saver Fund

- Mirae Asset ELSS Tax Saver Fund

- SBI ELSS Tax Saver Fund

ELSS funds allow teachers to claim ₹1.5 lakh deduction under Section 80C with a 3-year lock-in, making them more flexible than PPF.

SIP Amount: How Much Should a Teacher Invest Monthly?

| Monthly SIP | Investment Period | Potential Value* |

|---|---|---|

| ₹3,000 | 20 Years | ₹30–35 lakh |

| ₹5,000 | 20 Years | ₹50–60 lakh |

| ₹10,000 | 20 Years | ₹1–1.2 crore |

*Estimated at 12–14% annual returns.

Even teachers with modest salaries can start SIPs and increase them gradually with increments.

Also Read: How to check Quarterly Results for the Stock Market in India

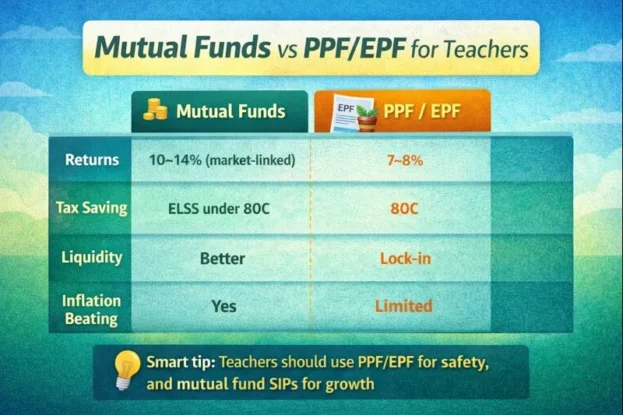

Mutual Funds vs PPF/EPF for Teachers

| Feature | Mutual Funds | PPF / EPF |

|---|---|---|

| Returns | 10–14% (market-linked) | 7–8% |

| Flexibility | High | Limited |

| Tax Saving | ELSS under 80C | 80C |

| Liquidity | Better | Lock-in |

| Inflation Beating | Yes | Limited |

Best approach: Teachers should use PPF/EPF for safety and mutual fund SIPs for growth.

FAQs: Best Mutual Funds and SIP Plans for Teachers

1. What are the best SIP mutual funds for teachers in India?

Large-cap, flexi-cap, hybrid, and ELSS funds are ideal for teachers.

2. Can teachers start SIP with ₹1,000 per month?

Yes, many mutual funds allow SIPs starting from ₹500–₹1,000.

3. Are mutual funds safe for government teachers?

Yes, when invested long-term in diversified funds.

4. Which mutual fund is best for teachers’ retirement?

Large-cap and multi-asset funds work best.

5. Are ELSS mutual funds good for teachers?

Yes, they offer tax savings and higher long-term returns.

6. Can retired teachers invest in SIPs?

Yes, conservative hybrid and debt funds are suitable.

7. What is the best low-risk mutual fund for female teachers?

Conservative hybrid and multi-asset funds.

8. Is SIP better than FD for teachers?

For long-term goals, SIPs usually outperform FDs.

9. How long should teachers stay invested in SIPs?

At least 10–15 years for meaningful wealth creation.

10. Should teachers invest in small-cap funds?

Only young teachers with long horizons and higher risk tolerance.

Final Thoughts: Smart Investing for Teachers

The best mutual funds and SIP plans to invest for a teacher are not about chasing the highest returns, but about discipline, consistency, and goal-based planning. Teachers who start early, invest monthly, and stay patient can comfortably build retirement security, fund children’s education, and beat inflation.

If you are unsure, start with one flexi-cap fund + one ELSS fund, and gradually diversify as your income grows.