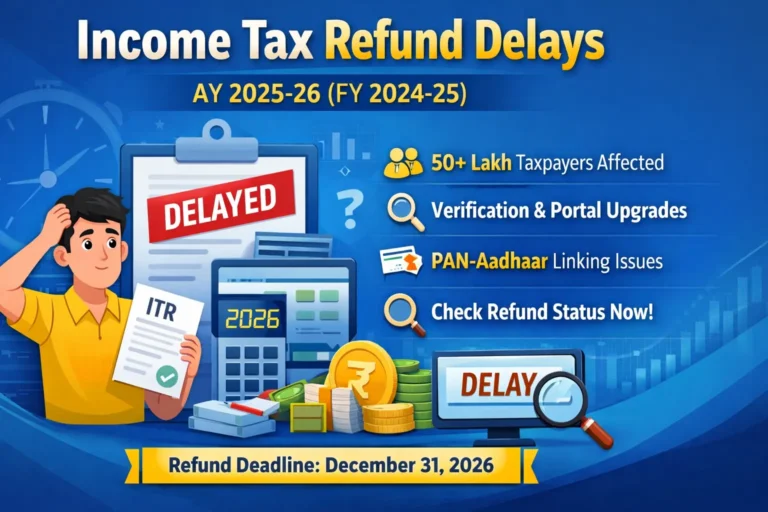

New Delhi, January 20, 2026 — Income tax refund delays for Assessment Year (AY) 2025-26 covering Financial Year (FY) 2024-25 have emerged as a pressing concern for millions of Indian taxpayers. As of mid-January 2026, over 50 lakh taxpayers nationwide are still awaiting their legitimate tax refunds despite filing returns correctly and within statutory deadlines.

The widespread delay is not an isolated incident but part of a systemic shift in how the Income Tax Department processes refunds. Enhanced verification protocols, comprehensive anti-fraud measures, ongoing income tax portal system upgrades, and stringent compliance reforms introduced by the Central Board of Direct Taxes (CBDT) have collectively contributed to the processing backlog.

This comprehensive guide addresses critical questions: Why are income tax refunds delayed? How can taxpayers check their refund status online? What immediate actions should be taken? When does Section 244A interest become applicable? We provide actionable solutions based on official Income Tax Department guidelines and expert tax consultant recommendations.

Understanding the Income Tax Refund Delay Crisis: Key Statistics and Timeline

The Income Tax Department has officially acknowledged processing delays for AY 2025-26 refunds. While lakhs of refunds have been successfully issued since processing began in mid-2025, a significant backlog persists as we enter 2026.

Critical Facts Every Taxpayer Should Know

- Assessment Year Affected: 2025-26

- Corresponding Financial Year: 2024-25 (April 1, 2024 to March 31, 2025)

- Pending Refund Cases (January 2026): Approximately 51 lakh taxpayers

- Legal Processing Deadline: December 31, 2026 (Section 143(1) of Income Tax Act, 1961)

- Interest Entitlement: Section 244A applies for eligible refund delays

- Average Processing Time: 45-120 days (currently extended in many cases)

- Total ITRs Filed for AY 2025-26: Over 8 crore returns

The Income Tax Department’s Centralized Processing Center (CPC) in Bengaluru handles the bulk of refund processing. Despite deploying advanced automation and artificial intelligence tools, the volume of returns combined with enhanced scrutiny measures has created processing bottlenecks.

Legal Framework: Time Limits for Income Tax Refund Processing

Under Section 143(1) of the Income Tax Act, 1961, the Income Tax Department has statutory authority to process returns filed for AY 2025-26 until December 31, 2026. This provision grants the department nearly 21 months from the original ITR filing deadline (July 31, 2025 for non-audit cases) to complete processing.

What This Legal Timeline Means for Indian Taxpayers

- Refund delays do not automatically indicate errors, rejections, or penalties in your income tax return

- The Income Tax Department may legally issue refunds anytime before the December 31, 2026 deadline

- Section 244A interest accrues automatically if processing extends beyond prescribed timelines

- Taxpayers retain the right to file rectification requests under Section 154 if intimation contains errors

Important Advisory: Tax experts and chartered accountants strongly advise against filing revised returns unless you receive explicit notice from the Income Tax Department or identify genuine errors in your original filing. Unnecessary revisions can trigger additional scrutiny and further delay refund processing.

10 Primary Reasons Behind Income Tax Refund Delays in 2026

The current refund delay is multifactorial, stemming from technology upgrades, compliance enforcement, data verification protocols, and fraud prevention initiatives. Understanding these reasons helps taxpayers take corrective action.

1. Data Mismatch Between ITR and Form 26AS/AIS/TIS

The most prevalent cause of income tax refund delays involves discrepancies between income declared in your Income Tax Return and information available in government databases:

- Form 26AS: Tax deduction and collection details from deductors

- Annual Information Statement (AIS): Comprehensive financial transaction data

- Taxpayer Information Summary (TIS): Curated summary of relevant financial information

Even minor mismatches—differences as small as ₹1 to ₹100—can trigger automated verification flags that halt refund processing. Common mismatch scenarios include:

- TDS claimed in ITR not reflecting in Form 26AS

- Interest income from savings accounts not matching bank reporting

- Capital gains transactions reported differently in AIS

- Dividend income discrepancies between ITR and AIS data

- Rental income variations between declaration and TDS records

The Income Tax Department’s AI-powered reconciliation system cross-verifies every data point before approving refunds, explaining why even small inconsistencies cause delays.

2. Pending or Failed E-Verification of Income Tax Returns

E-verification is mandatory for ITR processing. If your return remains unverified beyond 30 days from filing, the Income Tax Department treats it as invalid, and refund processing cannot commence.

Common E-Verification Failures Include:

- Aadhaar OTP not completed within the 120-day window

- Net banking e-verification attempted but not finalized

- EVC (Electronic Verification Code) generation errors

- Mobile number linked to Aadhaar not accessible

- Technical glitches during OTP submission

Critical Reminder: The income tax portal displays two distinct statuses—”ITR Filed” and “ITR Verified.” Only verified returns enter the processing queue. Always confirm your ITR status shows “Successfully e-Verified” within 30 days of filing.

3. Bank Account Pre-Validation Issues

The Income Tax Department credits refunds exclusively to pre-validated bank accounts linked with your PAN. Refund failures and delays frequently occur due to:

- Bank account not pre-validated on the income tax e-filing portal

- Inactive or dormant bank account selected for refund

- Incorrect IFSC code entered during ITR filing

- Bank account closed after ITR submission but before refund processing

- PAN not linked to the designated bank account in bank records

- Aadhaar seeding incomplete at bank level

Solution: Log into the income tax portal, navigate to Profile Settings → My Bank Accounts, and ensure your preferred account shows “Validated” status with EVC enabled. Pre-validation typically takes 24-48 hours.

Also Read: Bharat Coking Coal Share Investor Guide

4. PAN-Aadhaar Linking Compliance Issues

Despite multiple deadline extensions, PAN-Aadhaar linking remains a critical compliance requirement. The Income Tax Department will not process refunds for taxpayers whose PAN and Aadhaar remain unlinked or improperly linked.

Scenarios Causing Refund Blocks:

- PAN-Aadhaar linking not completed despite paying late fees

- Biometric or demographic mismatch between PAN and Aadhaar databases

- Name spelling variations between PAN card and Aadhaar card

- Date of birth discrepancies in PAN and Aadhaar records

- Aadhaar not updated after marriage or legal name change

The CBDT mandates that even if your ITR is processed and tax liability calculated, refunds remain blocked until PAN-Aadhaar linkage verification is complete. Verify linkage status at incometax.gov.in using the dedicated PAN-Aadhaar link status checker.

5. High-Value Transaction Alerts and Risk Profiling

The Income Tax Department’s Risk Management System (RMS) automatically flags taxpayers with high-value transactions for detailed verification before approving refunds. Risk indicators include:

- Large cash deposits exceeding ₹10 lakh during FY 2024-25

- Substantial mutual fund investments or redemptions

- Significant cryptocurrency trading activity

- High-volume equity or derivatives transactions

- Property purchases or land acquisition registrations

- Foreign remittances or forex transactions

- Luxury goods purchases (vehicles, jewelry above specified limits)

Cases flagged by RMS undergo manual assessment by assessing officers, significantly extending refund processing timelines from weeks to several months. This scrutiny aims to detect tax evasion, money laundering, and benami transactions.

6. CBDT ‘Nudge’ Compliance Campaign and Taxpayer Alerts

The Central Board of Direct Taxes launched an extensive ‘Nudge’ campaign to proactively alert taxpayers about potential discrepancies before finalizing assessments. Taxpayers receive communications via:

- Email notifications to registered email addresses

- SMS alerts to mobile numbers linked with PAN

- Direct messages on the income tax e-filing portal dashboard

- Alerts in the AIS Feedback Utility

Common Nudge Scenarios:

- Unreported income detected in AIS but absent from ITR

- TDS claim mismatches requiring clarification

- High-value transactions not adequately explained

- Deduction claims requiring documentary evidence

- Investment declarations needing verification

Ignoring nudge notifications or delaying responses automatically pauses refund processing. The Income Tax Department treats non-response as potential non-compliance, triggering deeper investigation.

7. Anti-Fraud Measures and Bogus Refund Claim Detection

To combat organized tax fraud and bogus refund claims, the Income Tax Department has implemented sophisticated detection mechanisms that scrutinize:

- Fake TDS Claims: Fabricated Form 16/16A certificates

- Inflated HRA Exemptions: Rent receipts from fictitious landlords

- Spurious Business Losses: Created to reduce tax liability

- Round-Tripping Schemes: Circular money flows to claim deductions

- Identity Theft Cases: Fraudulent ITRs filed using stolen PAN details

First-time ITR filers claiming substantial refunds, taxpayers with unusual refund patterns, and cases involving suspicious deductors face heightened scrutiny. The department cross-verifies deductor authenticity, landlord identities, and transaction genuineness before approving refunds.

Also Read: New Train Ticket Cancellation Rules 2026: Indian Railways Issues Major Update

8. Income Tax Portal Modernization and System Upgrades

The new income tax e-filing portal (launched in 2021 and continuously upgraded) undergoes regular backend enhancements to improve functionality. Recent system changes include:

- Introduction of Updated Income Tax Return (ITR-U) filing utilities

- Enhanced AIS integration with ITR processing workflows

- Upgraded refund banker system interfaces

- New Excel utilities for offline ITR preparation

- Improved data validation algorithms

While these upgrades ultimately streamline processing, they temporarily disrupt normal workflows, causing processing delays across multiple assessment years. Technical glitches, server downtimes, and integration challenges have affected refund disbursement schedules.

9. Increased Scrutiny Assessment Selection

For AY 2025-26, the Income Tax Department has expanded scrutiny assessment selection criteria using advanced data analytics. Cases selected for scrutiny experience significant refund delays as they undergo detailed examination.

Scrutiny Selection Factors:

- ITR data significantly diverging from previous years

- Large capital gains without corresponding investment trail

- Substantial foreign income or assets

- Business income with abnormally high expense ratios

- Professional income without proportionate expenses

- Cash transactions exceeding specified thresholds

Taxpayers selected for scrutiny receive formal notices under Section 143(2) requiring document submission and explanations. Refunds remain withheld until scrutiny proceedings conclude.

10. Workload Pressure at Centralized Processing Center

The sheer volume of ITRs filed for AY 2025-26—exceeding 8 crore returns—has created unprecedented workload at the CPC Bengaluru. Despite automation, certain verification steps require manual intervention, creating processing queues.

The Income Tax Department prioritizes processing based on multiple factors including filing date, refund amount, taxpayer category, and risk assessment scores. Senior citizens and low-income taxpayers generally receive priority processing, while complex corporate returns or high-net-worth individual cases take longer.

How to Check Income Tax Refund Status: Step-by-Step Guide

Checking your income tax refund status regularly helps you track progress and identify issues requiring attention. The Income Tax Department provides multiple official channels for refund status verification.

Method 1: Income Tax E-Filing Portal (Official Method)

Step-by-Step Process:

- Navigate to the official income tax e-filing portal at www.incometax.gov.in

- Click “Login” and enter your PAN as User ID

- Enter password and complete two-factor authentication

- After successful login, click “e-File” in the main menu

- Select “Income Tax Returns” from the dropdown

- Click “View Filed Returns” option

- Select Assessment Year 2025-26 from the list

- Review the comprehensive status display showing:

- ITR filing date and acknowledgment number

- E-verification status and date

- Processing status (Processed/Pending/Under Verification)

- Refund determination and amount

- Refund payment status (Issued/Adjusted/Failed/Pending)

- Refund banker details and transaction reference number

- Section 143(1) intimation availability

Status Interpretations:

- Refund Issued: Amount successfully credited to your bank account

- Refund Adjusted: Refund set off against outstanding tax demands

- Refund Failed: Bank credit failed due to account issues (re-issue required)

- Under Processing: ITR verification underway at CPC

- Pending for E-Verification: Urgent action required within 30 days

Method 2: NSDL TIN Refund Status Tracker

The National Securities Depository Limited (NSDL) operates an independent refund tracking portal accessible without login credentials:

Access Process:

- Visit tin.tin.nsdl.com/oltas/refundstatuslogin.html

- Enter your PAN in the designated field

- Select Assessment Year 2025-26 from dropdown

- Complete CAPTCHA verification

- Click “Submit” to view refund lifecycle status

The NSDL portal displays refund processing stages including receipt at refund banker, dispatch status, credit date, and failure reasons if applicable.

Method 3: Refund Status via SMS (Mobile)

Send an SMS to 98998 98998 in the following format:

ITREFUND [SPACE] PAN

Example: ITREFUND ABCDE1234F

You’ll receive an automated response containing current refund status for the most recent assessment year.

Immediate Action Plan: What Taxpayers Should Do Now

If your income tax refund for AY 2025-26 remains pending beyond expected timelines, follow this comprehensive action checklist to resolve issues and accelerate processing.

Action 1: Cross-Verify Form 26AS, AIS, and TIS Data

Detailed Verification Steps:

- Download Form 26AS from the income tax portal or TRACES website

- Access your Annual Information Statement (AIS) via the e-filing portal

- Review Taxpayer Information Summary (TIS) for curated data

- Compare systematically:

- TDS deducted by employers (salary, interest, commission)

- Advance tax and self-assessment tax payments

- Interest income from banks and post office deposits

- Dividend income from equity shares and mutual funds

- Capital gains transactions (property, shares, mutual funds)

- High-value transactions reported by financial institutions

If Mismatches Identified:

- Use the AIS Feedback Utility to accept correct information or report incorrect data

- Request TDS correction certificates from deductors if Form 26AS contains errors

- File rectification request under Section 154 if you’ve already received intimation

- Update corrected information through the AIS Feedback module (responses processed within 30 days)

Action 2: Complete E-Verification Immediately

If your ITR status displays “Pending for e-Verification,” complete verification urgently using any of these methods:

Available E-Verification Options:

- Aadhaar OTP: Instant verification via OTP sent to Aadhaar-registered mobile (valid for 120 days from filing)

- Net Banking: Through authorized banks (limited to 24 hours after filing)

- Bank Account EVC: Generate and use Electronic Verification Code

- Demat Account: Verify through NSDL/CDSL demat account

- Bank ATM: Generate EVC from select bank ATMs

- ITR-V Submission: Physical signature verification (mail signed ITR-V acknowledgment to CPC Bengaluru within 30 days)

Critical Deadline: Complete e-verification within 30 days of ITR filing. Post this deadline, your return becomes invalid and you must file a fresh return (if within the original or belated filing deadline).

Action 3: Pre-Validate Bank Account for Refund Credit

Bank Account Validation Process:

- Log into income tax e-filing portal

- Navigate to Profile Settings → My Bank Accounts

- Add new bank account if your preferred account isn’t listed

- Enter accurate details:

- Bank name (select from dropdown)

- Account number (verify twice)

- IFSC code (verify from bank passbook/statement)

- Account type (Savings/Current)

- Click “Pre-Validate”

- Complete EVC authentication via net banking or demat account

- Wait 24-48 hours for validation confirmation

Validation Status Check: The account status should change from “Not Validated” to “Validated” with a green checkmark. Only validated accounts appear in the refund credit account dropdown during ITR filing.

Important: Ensure the bank account selected in your filed ITR matches a pre-validated account. If you’ve changed accounts after filing, you cannot modify the refund account without filing a revised return (only possible before the original filing deadline).

Action 4: Respond to Nudge Notices and Compliance Alerts

When You Receive Nudge Communications:

- Never ignore emails, SMS, or portal notifications from the Income Tax Department

- Log into the e-filing portal immediately to check detailed communications

- Review the specific discrepancy or information request

- Navigate to e-Proceedings tab to view formal notices

- Use the AIS Feedback Utility to respond to information mismatches

- Provide explanations or upload supporting documents as requested

- Submit responses within specified deadlines (typically 15-30 days)

Common Response Actions:

- Accept correct information and explain reasons for non-reporting

- Dispute incorrect information with evidence

- Provide source documents (Form 16, bank statements, investment proofs)

- Clarify high-value transactions with legitimate explanations

Prompt compliance responses demonstrate cooperation and often lead to faster refund approval. Non-response may result in notices under Section 143(1)(a) demanding taxes on unreported income.

Action 5: Verify PAN-Aadhaar Linking Status

Verification and Correction Steps:

- Visit incometax.gov.in or eportal.incometax.gov.in

- Access “Link Aadhaar Status” (available without login)

- Enter PAN and Aadhaar numbers

- Check linkage status displayed

If Not Linked or Showing Errors:

- Complete linking at incometax.gov.in → Quick Links → Link Aadhaar

- Pay late linking fee of ₹1,000 if linking after the deadline

- If demographic mismatches exist, update details in UIDAI database first

- Visit Aadhaar enrollment center for biometric updates if name/DOB differs significantly

- After successful linking, allow 3-5 working days for system updates

Action 6: Update Communication Details

Ensure the Income Tax Department can reach you without communication failures:

Details to Verify and Update:

- Email address (primary and alternate)

- Mobile number (registered with Aadhaar)

- Residential address

- Communication address if different from residential

Update these through Profile Settings on the e-filing portal. Verified communication details ensure you receive timely notices, refund updates, and compliance alerts.

Action 7: Contact Income Tax Helpdesk for Complex Cases

If your refund remains pending despite verification and compliance, contact official support channels:

Income Tax Helpline: 1800 103 0025 / 1800 419 0025 (toll-free)

Operating Hours: Monday to Friday, 9:30 AM to 6:00 PM (except public holidays)

Information to Keep Ready:

- PAN number

- Assessment Year 2025-26

- ITR acknowledgment number

- CPC reference number (if available in intimation)

- Bank account details used for refund

- E-filing portal registered mobile number

Alternative Contact Methods:

- Email: Contact through grievance redressal option on e-filing portal

- E-Nivaran Portal: File formal grievances at eportal.incometax.gov.in/iec/foservices/#/pre-login/e-Nivaran

- Aaykar Sampark Kendra: Visit nearest ASK for in-person assistance

Maintain reference numbers and documentation of all communications for future follow-up.

Understanding Section 244A Interest on Delayed Refunds

Section 244A of the Income Tax Act, 1961, mandates that the Income Tax Department pays interest on delayed refund processing, compensating taxpayers for the time value of money withheld beyond prescribed timelines.

Section 244A Interest Calculation Framework

Interest Rate: 0.5% per month or part of month (equivalent to 6% per annum)

Interest Calculation Period:

- For refunds arising from regular assessment: From the date of payment of tax or the due date for filing return of income, whichever is later, to the date of grant of refund

- For refunds from self-assessment tax: From the date of payment to the date of refund issue

- For refunds from advance tax/TDS: From April 1 of the assessment year to the date of refund

Automatic Credit: Section 244A interest is calculated and credited automatically along with the principal refund amount. The Income Tax Department issues a combined payment reflecting both refund amount and interest component separately.

Interest Payment Examples for AY 2025-26

Example 1: Salaried Employee with TDS Refund

- Assessment Year: 2025-26

- ITR Filing Date: July 15, 2025

- Refund Amount: ₹25,000

- Refund Issue Date: March 15, 2026

- Interest Period: April 1, 2025 to March 15, 2026 = 11.5 months

- Interest Calculation: ₹25,000 × 0.5% × 11.5 = ₹1,437.50

- Total Credit: ₹26,437.50

Example 2: Self-Assessment Tax Refund

- Self-Assessment Tax Paid: March 20, 2025 (₹50,000)

- Actual Tax Liability: ₹30,000

- Refund Due: ₹20,000

- Refund Issued: January 10, 2026

- Interest Period: March 20, 2025 to January 10, 2026 = 9.67 months

- Interest: ₹20,000 × 0.5% × 9.67 = ₹967

- Total Credit: ₹20,967

Important: Section 244A interest is taxable income and must be reported in the ITR for the year in which it is received.

When Refunds Are Adjusted Instead of Issued

Sometimes taxpayers notice their refund status shows “Refund Adjusted” instead of “Refund Issued.” This indicates the Income Tax Department has set off your refund against outstanding tax liabilities.

Situations Leading to Refund Adjustment

Under Section 245: The department can adjust refunds against:

- Outstanding tax demands from previous assessment years

- Penalty amounts imposed in earlier assessments

- Interest on delayed tax payments from past years

- Any other sum payable under the Income Tax Act

The adjustment happens automatically during processing. You receive intimation under Section 143(1) showing:

- Total refund determined: ₹X

- Adjustment against demand for AY [Year]: ₹Y

- Net refund payable: ₹Z (if any balance remains)

Disputing Incorrect Adjustments

If you believe the adjustment is incorrect or relates to disputed demands:

- Log into the e-filing portal and check Outstanding Tax Demand section

- Review demands listed with assessment year details

- If demand is under appeal or stayed by higher authorities, file rectification request

- Submit representation through e-Nivaran portal explaining the error

- If necessary, contact jurisdictional Assessing Officer with supporting documents

Valid grounds for disputing adjustment:

- Demand already paid but not updated in records

- Demand under appeal with stay granted by CIT(A) or ITAT

- Demand from incorrect or duplicate assessments

- Demand barred by limitation period

What “Refund Failed” Status Means and How to Resolve

“Refund Failed” status indicates the Income Tax Department issued the refund to the refund banker, but bank credit to your account failed.

Common Causes of Refund Failure

- Bank account number entered incorrectly in ITR

- IFSC code error in ITR filing

- Account closed or frozen after ITR submission

- Name mismatch between PAN records and bank account

- Account not operational due to KYC non-compliance

- Technical issues at banker’s end during credit processing

Refund Re-Issue Request Process

Step-by-Step Resolution:

- Log into income tax e-filing portal

- Go to Services → Refund Re-issue Request

- Select Assessment Year 2025-26

- Verify current bank account details or update to a different pre-validated account

- Submit re-issue request

- Track request status under Services → Refund Re-issue Status

The Income Tax Department typically processes re-issue requests within 15-30 days after verification. Ensure you’ve resolved the underlying account issue before submitting the request.

Special Considerations for Different Taxpayer Categories

Senior Citizens (60 Years and Above)

The Income Tax Department generally prioritizes refund processing for senior citizens. However, the same verification protocols apply. Senior citizens should:

- Ensure bank account pre-validation is complete

- Keep mobile number and email updated for communications

- Seek assistance from authorized representatives or tax practitioners if needed

- Take advantage of simplified ITR forms (ITR-1 Sahaj for eligible cases)

First-Time ITR Filers

New taxpayers filing ITR for the first time often face additional scrutiny. Best practices include:

- Double-check all data entries against Form 16/26AS

- Verify bank account details multiple times before submission

- Complete e-verification immediately after filing

- Maintain digital and physical copies of all supporting documents

- Respond promptly to any nudge or verification requests

NRIs (Non-Resident Indians)

Non-resident taxpayers claiming refunds must ensure:

- Correct residential status selected in ITR

- Foreign income taxed in India properly reported

- DTAA benefits claimed with supporting documents (Tax Residency Certificate)

- NRE/NRO account details accurately provided for refund credit

- Form 15CA/15CB compliance for foreign remittances if applicable

NRI refund processing typically takes longer due to cross-border verification requirements and FEMA compliance checks.

Business Owners and Professionals

Taxpayers with business or professional income filing ITR-3 or ITR-4 should:

- Ensure presumptive taxation schemes (Section 44AD/44ADA) are correctly applied

- Match revenue reported in ITR with GST returns (if GST-registered)

- Provide complete details of business bank accounts

- Maintain proper books of accounts and audit reports if turnover exceeds limits

- Respond comprehensively to queries about business expenses and deductions

Frequently Asked Questions About Income Tax Refund Delays

Q1: Is income tax refund delay normal for Assessment Year 2025-26?

Answer: Yes, refund delays for AY 2025-26 are widespread and affect over 50 lakh taxpayers nationwide as of January 2026. The delays result from enhanced verification processes, system upgrades, and stricter compliance checks implemented by the Income Tax Department. This is a systemic issue, not indicative of individual errors.

Q2: Can the Income Tax Department legally delay my refund until December 31, 2026?

Answer: Yes. Under Section 143(1) of the Income Tax Act, 1961, the Income Tax Department has statutory authority to process returns and issue refunds until December 31, 2026, for Assessment Year 2025-26. However, if processing extends beyond reasonable timelines, you’re entitled to interest under Section 244A at 0.5% per month.

Q3: Should I file a revised return if my refund is delayed?

Answer: No. Do not file a revised return unless you receive an official notice from the Income Tax Department pointing out specific errors, or you identify genuine mistakes in your original filing. Unnecessary revisions can trigger additional scrutiny and further delay refund processing. Revised returns for AY 2025-26 can only be filed before December 31, 2025 (the original deadline for filing).

Q4: What does “Refund Adjusted” status mean in my ITR?

Answer: “Refund Adjusted” indicates the Income Tax Department has set off your refund against outstanding tax demands from previous assessment years under Section 245. Check your Outstanding Tax Demand section on the e-filing portal to view details of demands against which your refund was adjusted. If you believe the adjustment is incorrect, file a rectification request.

Q5: What should I do if refund status shows “Refund Failed”?

Answer: “Refund Failed” means bank credit to your account was unsuccessful despite refund issuance. Immediately verify and update your bank account details on the income tax portal, ensuring the account is active and pre-validated. Then file a Refund Re-Issue Request through Services → Refund Re-issue on the e-filing portal. The department will reprocess the refund within 15-30 days.

Q6: How long does Section 244A interest take to credit?

Answer: Section 244A interest is calculated automatically and credited along with your principal refund amount. The interest component appears separately in the intimation under Section 143(1) and in your bank account credit details. There’s no separate timeline—interest comes with the refund.

Q7: Can I call the Income Tax Department to check my refund status?

Answer: Yes. Contact the Income Tax Helpline at 1800 103 0025 (toll-free) between 9:30 AM to 6:00 PM on working days. Keep your PAN, assessment year, acknowledgment number, and registered mobile number ready. For complex issues, file a grievance through the e-Nivaran portal for documented resolution.

Q8: Will I lose my refund if processing extends beyond December 2026?

Answer: No. Your refund entitlement doesn’t expire. However, if the department fails to process your return within the prescribed timeline due to non-response from your end or unresolved discrepancies, you may need to file a rectification request or respond to assessment notices. Legitimate refunds are eventually processed.

Q9: Does ignoring nudge SMS or email affect my refund?

Answer: Yes, significantly. Ignoring nudge communications or compliance alerts automatically pauses refund processing. The Income Tax Department treats non-response as potential non-compliance, triggering deeper investigation and possible assessment proceedings. Always respond promptly through the AIS Feedback Utility or e-Proceedings section.

Q10: Can I withdraw excess TDS deposited by my employer if refund is delayed?

Answer: No. Once TDS is deducted and deposited with the government, only the Income Tax Department can refund excess tax through the normal ITR processing mechanism. You cannot directly withdraw or claim TDS from your employer. Your only recourse is to ensure your ITR is correctly filed, verified, and compliance issues are resolved.