How to Calculate Interest On a Personal Loan? Taking out a personal loan is a frequent financial approach for various reasons, including debt consolidation, wedding funding, and unforeseen needs. Understanding how interest on a personal loan is computed is critical for efficient financial management.

Determining the interest on a personal loan is a simple process involving key factors: the loan amount, interest rate, and loan term. Personal loan interest is typically computed using a basic formula that focuses on the initial loan amount, excluding any previously accrued interest.

Ways to Calculate Interest on Personal Loan

1. Know Your Loan Terms:

To calculate the interest on your loan, you need to know the loan amount, interest rate (expressed annually), and loan term (in years or months). These details are typically outlined in your loan agreement.

2. Understand the types of interest rates:

- Simple Interest: Calculated only on the original loan amount.

- Compound Interest: Calculated on the original loan amount and any previously accumulated interest.

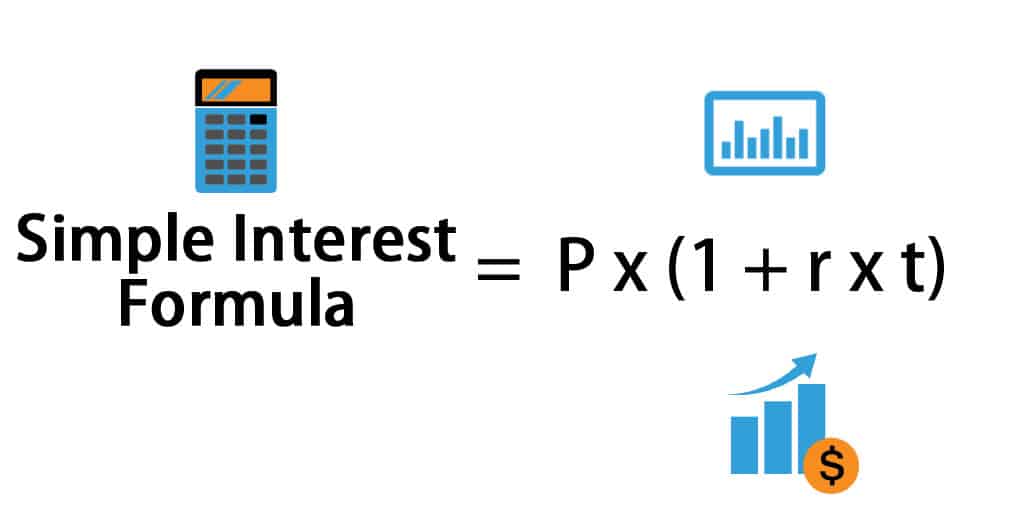

3. Calculate simple interest:

Simple interest is straightforward, but it’s less commonly used for personal loans.

- Using the Formula: Simple Interest (SI) = Principal Amount (P) × Interest Rate (R) × Period (T) / 100

- Example: If you borrow ₹50,000 at an annual interest rate of 10% for 2 years, the simple interest would be ₹10,000 (₹50,000 × 10% × 2).

Recommended: Best Business Loans for Women Entrepreneurs in India

4. Calculate compound interest:

Compound interest, which accounts for interest on both the principal and the accumulated interest, is used in the majority of personal loans. The formula for compound interest is more complex:

- Using the Formula: Compound Interest (CI) = P × (1 + (R / n))^(n × t) – P

- Example: If you borrow ₹50,000 at an annual interest rate of 10% compounded quarterly for 2 years, the compound interest would be approximately ₹10,471.30.

5. Use online calculators:

There are several online calculators accessible to calculate personal loan interest effectively. You enter the loan information, and the calculator calculates the total interest payable and the payback plan.

6. Understand Amortization:

An amortisation schedule breaks down each loan payment into its parts, showing how much goes towards principal and interest. Payments on personal loans are frequently arranged using an amortisation plan. Initially, a bigger percentage of your monthly payment is used to pay interest, with the remaining going towards principal reduction. As the principal drops, so does the interest.

Recommended: Paving the Way for Business Success Through Digital Innovation

7. Consider Prepayment:

If your loan permits for penalty-free prepayment, making extra payments can dramatically reduce the total interest paid. Before making further payments, calculate the potential savings.

8. Read Your Loan Agreement:

Always carefully read the terms and conditions of your loan agreement. Understand if the interest is calculated on a reducing balance or at a flat rate, as this affects the total interest paid. The loan agreement provides a detailed explanation of the loan terms. This includes the interest rate, whether fixed or variable, the loan duration, and the total amount you’ll repay. Understanding these terms ensures you know exactly what you are committing to.

9. Review Regularly:

Keep an eye on your outstanding balance, the interest being charged, and the remaining tenure. Regularly reviewing your loan status can help you make informed financial decisions.

Conclusion

Responsible money management requires an understanding of how personal loan interest is computed. Through the careful consideration of variables such as interest rate, loan amount, and term, borrowers can make well-informed judgements about their financial obligations.

Furthermore, the utilisation of online calculators and amortisation schedules can offer a more comprehensive understanding of the loan payback process, enabling consumers to confidently manage their loans and create successful budgets.