The fixed date of July 31 for filing Income Tax Return (ITR) for Assessment Year 2024-25 i.e. Financial Year 2023-24 is fast approaching, before you go to the e-filing portal at www.incometax.gov.in, collect all the necessary documents to file ITR. The Income Tax Department has said that more than five crore taxpayers have already filed their returns.

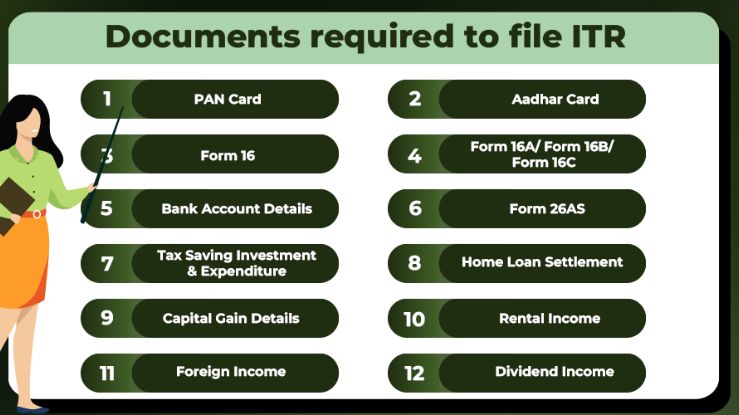

What documents are required to file income tax return?

- Bank TDS certificates

- Bank account details

- Aadhaar and PAN linked to 26AS and Annual Information Statement (AIS).

- Form-16 for salaried individuals

- Previously filed tax returns

- Salary slips including income earned from abroad, if applicable.

- Rent agreement and rent receipts for claiming HRA.

- Foreign bank account details if you went on deputation abroad.

- Transaction details of foreign investment.

- Form 67 if you are claiming credit of taxes paid in a country with which India has a Double Taxation Avoidance Treaty.

- Details of your assets and liabilities, including AL schedule, if your income is more than INR 50 lakh and you are filing return through ITR-1.

Documents required for deduction

For Section 80C and 80CCD (1B) deductions

Proof of investing in equity-linked savings schemes (ELSS).

National Pension System (NPS) contribution proof.

Premium receipts of life insurance premiums.

For Section 80D deduction: Health insurance receipt

For Section 80E deduction: Interest certificate from the bank that gave the education loan.

For Section 24B deduction: Interest certificate from your bank to claim deduction up to INR 2 lakh under Section 24(B).

For Section 80G deduction: Receipts of donations to eligible charitable institutions.

Also Read: Karnataka Man Devises Plan to Save 100% Income Tax- Watch Viral Video

Documents for income from sources

Capital gain/loss statement issued by mutual fund houses or intermediaries, stock brokers, etc.

Bank account details and TDS certificate.

Virtual Digital Assets (VDA) transaction statement, especially the VDA schedule.