The Income Tax Department has started sending the refund amount to the accounts of taxpayers who filed income tax returns early. However, the refund of many people is still pending, while the refund of some people is also stuck due to errors in ITR filing 2024. In this article, we will tell you how to check your ITR refund from home with the help of PAN card. Actually, you can check the status of income tax refund through the National Security Depository (NSDL) website.

These things will be needed

- To check income tax refund online, you must have an ID and password to login to the e-filing portal

- To check the status of refund, your PAN card must be linked to Aadhaar.

- You must have the acknowledgement number of the ITR filed.

How to check ITR Refund Status with the help of PAN card

- First of all, you have to login to the income tax e-filing portal incometax.gov.in with the help of ID and password.

- After logging in to the web portal, click on ‘e-File’. After this, you have to do Income Tax Return and View Filed Return.

- After this, you can check your refund status by selecting the assessment year.

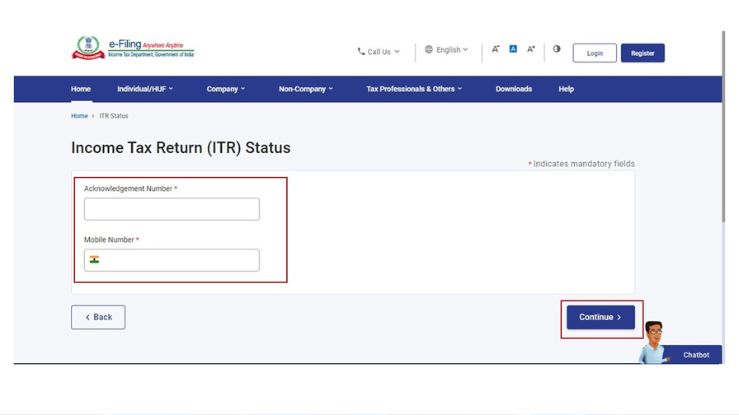

How to check ITR refund status through NSDL website

- To check income tax refund status with the help of NSDL website, first of all you have to visit the NSDL website and select the assessment year.

- After this, you have to fill the captcha code and click on Proceed.

- After this your ITR refund will start showing.

How many days does it take for ITR Refund to come?

The most important thing to get income tax refund is to verify your online ITR return. Usually it takes 30 to 45 days for the ITR refund to arrive. If you have not received the refund, you should check your email to see if any information related to it has been given by the Income Tax Department.