Will Budget 2026 help the middle class people is the big question after the Union Budget 2026–27 announcement. The budget was presented by Nirmala Sitharaman on January 31, 2026, with a clear focus on fiscal discipline and growth.

For salaried taxpayers, expectations were high due to inflation and rising living costs. However, the budget delivered selective relief instead of broad tax cuts.

Understanding the Middle-Class Expectations

The Indian middle class largely expected higher income tax exemptions and revised slabs. Many households are dealing with higher EMIs, education fees, and healthcare expenses.

In that context, the absence of slab changes felt disappointing to a large section of salaried earners. The demand was clear, but the response was cautious.

No Change in Income Tax Slabs

One of the biggest talking points is that income tax slabs remain unchanged in Budget 2026. The tax-free income limit effectively stays near ₹12.75 lakh, including the standard deduction.

This means there are no direct savings for middle-income salaried individuals. As a result, immediate monthly disposable income does not improve.

Impact of Union Budget 2026 on Middle-Class Taxpayers

| Category | Budget 2026 Provision | What Changed | The earlier rate was 5% |

|---|---|---|---|

| Income Tax Slabs | No revision in slabs | Tax rates and exemption limits remain unchanged | No direct tax savings for salaried individuals |

| Standard Deduction | ₹75,000 (unchanged) | No increase despite inflation | Disposable income remains under pressure |

| Tax-Free Income Limit | ~₹12.75 lakh (with deductions) | Status quo maintained | Expectations of higher relief unmet |

| LRS – Education & Medical | TCS reduced to 2% | Earlier rate was 5% | Lower upfront cost for overseas education and treatment |

| Healthcare (Cancer Drugs) | Customs duty removed on 17 drugs | Import costs reduced | Better affordability for life-saving medicines |

| Tax Compliance | Staggered filing deadlines | Less rush during tax season | Reduced compliance stress for salaried taxpayers |

| Share Buybacks | Taxed as capital gains | Earlier treated as dividend income | Clearer and often lower tax for retail investors |

| Capital Expenditure | Increased allocation | Focus on infrastructure and jobs | Indirect long-term benefit, not immediate |

| Disability Pension Exemptions | Some exemptions withdrawn | Reduced tax relief | Higher burden for affected families |

| New Tax Regime | Continued promotion | Simpler slabs, fewer deductions | Benefits young earners more than traditional families |

Why the Government Avoided Tax Cuts

The government chose fiscal prudence over popular tax relief measures. The focus remains on controlling the fiscal deficit while boosting capital expenditure.

According to policy reasoning, long-term job creation and infrastructure growth are expected to indirectly benefit the middle class. This approach favors stability over short-term gains.

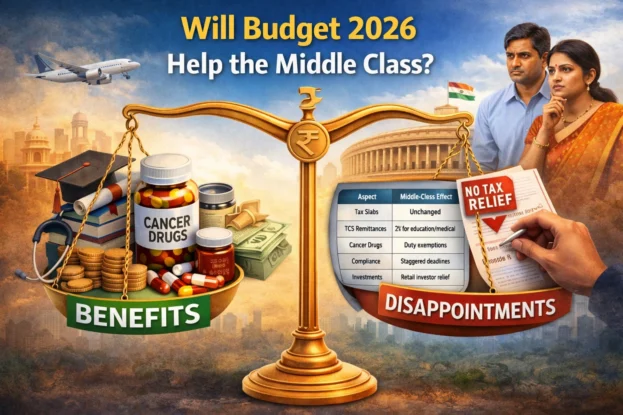

Relief Through Lower TCS on Remittances

A notable benefit comes from the reduction in TCS under the Liberalised Remittance Scheme. For education and medical purposes, TCS has been reduced from 5% to 2%.

This change directly helps middle-class families fund overseas education or critical medical treatment. It also reduces cash flow pressure during large remittances.

Also Read: 800+ People Missing in Delhi: Real or Fake? The Truth Behind the Shocking Claim

Cheaper Cancer Drugs and Healthcare Support

Budget 2026 removes customs duties on 17 cancer-related drugs. This step aims to make life-saving treatment more affordable.

For middle-class families facing high medical costs, this offers meaningful relief. Healthcare affordability remains one of the budget’s strongest positives.

Compliance Ease for Salaried Taxpayers

The budget introduces staggered tax filing deadlines to reduce last-minute pressure. This move is designed to simplify compliance and improve filing accuracy.

For salaried individuals and small investors, this change reduces stress and dependency on tax consultants. It improves the overall tax experience.

Change in Buyback Taxation

Share buybacks will now be taxed as capital gains instead of dividend income. This aligns buyback taxation with global practices.

Retail investors, including many middle-class taxpayers, benefit from clearer and often lower tax treatment. It brings predictability to investment planning.

Cost Impact Details for Middle-Class Families

The real impact of Budget 2026 lies in cost management rather than income growth. Reduced TCS, cheaper drugs, and compliance ease lower indirect financial burdens.

However, fixed monthly expenses like rent, fuel, and groceries remain unaffected. This limits the overall perception of relief.

Key Cost and Benefits

| Area of Impact | Budget 2026 Change | Cost Effect on Middle Class |

|---|---|---|

| Income Tax Slabs | No revision | No direct savings |

| Overseas Education | TCS reduced to 2% | Lower upfront remittance cost |

| Cancer Treatment | Customs duty removed | Reduced medicine expenses |

| Tax Filing | Staggered deadlines | Lower compliance stress |

| Investments | Buybacks as capital gains | Better tax clarity |

Areas Where the Budget Disappointed

The lack of changes in the standard deduction was another setback. Middle-class taxpayers earning up to ₹15 lakh expected inflation-linked relief.

Additionally, some disability pension exemptions were withdrawn. This negatively affects vulnerable middle-income households.

Indirect Benefits Through Growth Focus

The budget significantly increases capital expenditure on infrastructure. This is expected to generate employment and support wage growth over time.

For young professionals and new entrants, this growth-first approach may yield benefits in the medium term. The impact, however, is not immediate.

Expert and Middle-Class Reactions

Many experts believe the budget favors macroeconomic stability. The middle class, however, remains divided in its response.

While some appreciate healthcare and compliance reforms, others feel ignored due to stagnant tax slabs. The sentiment is mixed but cautious.

Does Budget 2026 Support the New Tax Regime?

The government continues to promote the new tax regime with simpler slabs. This regime mainly benefits young earners with fewer deductions.

For traditional middle-class families relying on exemptions, the old regime still feels restrictive. The transition remains uneven.

Final Verdict: Will Budget 2026 Help the Middle Class People?

Will Budget 2026 help the middle class people depends on perspective. There is limited direct tax relief but meaningful support in healthcare, remittances, and compliance.

For long-term growth and stability, the budget makes sense. However, for immediate household savings, many middle-class taxpayers may feel underwhelmed.

Conclusion

Union Budget 2026–27 prioritizes economic stability over populist tax cuts. The middle class gains indirectly through cost reductions and growth-oriented policies.

While it may not fully meet expectations, the budget lays the groundwork for sustainable benefits. The real test will be how these measures translate into future income growth.